What are solicitors’ fees for selling a house?

When it comes to selling a house, there are numerous costs involved, and one of the most significant expenses is often solicitors’ fees. These fees can vary widely depending on the complexity of the sale, the location, and the solicitor’s experience. But what exactly do solicitors’ fees cover, and how can you budget for them? In this article, we’ll delve into the world of solicitors’ fees for selling a house, exploring what they entail, how they’re calculated, and most importantly, how to minimize them without compromising on the quality of service.

Understanding Solicitors’ Fees for Selling a House

When selling a house, one of the significant expenses you’ll incur is solicitors’ fees. These fees can vary depending on several factors, including the location, complexity of the transaction, and the solicitor’s experience. In this article, we’ll delve into the details of solicitors’ fees for selling a house, what they cover, and how you can minimize them.

What Do Solicitors’ Fees Cover?

Solicitors’ fees for selling a house typically cover a range of services, including: Preparing and drafting the sale contract Conducting searches and enquiries on the property Dealing with the buyer’s solicitor and negotiating the terms of the sale Preparing and submitting the transfer deed Attending to the completion of the sale Providing advice and guidance throughout the process

How Much Do Solicitors Charge for Selling a House?

The cost of solicitors’ fees for selling a house can vary widely, but typically ranges from £500 to £2,000 or more, depending on the complexity of the transaction and the solicitor’s fees. Some solicitors may charge a fixed fee, while others may charge an hourly rate or a percentage of the sale price.

What Factors Affect Solicitors’ Fees?

Several factors can affect the cost of solicitors’ fees for selling a house, including: Location: Solicitors’ fees can vary depending on the location of the property, with city-centre solicitors typically charging more than those in smaller towns or rural areas. Complexity of the transaction: If the sale involves complex issues, such as multiple owners or disputed boundaries, the solicitor’s fees may be higher. Experience of the solicitor: More experienced solicitors may charge higher fees due to their expertise and reputation.

How Can You Minimize Solicitors’ Fees?

While solicitors’ fees are a necessary expense when selling a house, there are ways to minimize them: Shop around: Compare fees and services from different solicitors to find the best deal. Choose a fixed-fee solicitor: Fixed-fee solicitors can provide cost certainty and avoid unexpected costs. Prepare documents in advance: Having all necessary documents ready can reduce the solicitor’s workload and fees.

What Are the Disbursements Involved?

In addition to solicitors’ fees, there are other costs involved in selling a house, known as disbursements. These can include: Land Registry fees Search fees Stamp Duty Land Tax Electronic money transfer fees

| Solicitor’s Fee | Disbursement | Total Cost |

|---|---|---|

| £800 | £200 | £1,000 |

| £1,200 | £300 | £1,500 |

| £1,500 | £400 | £1,900 |

Note: The above table is an example of how solicitors’ fees and disbursements can add up. The actual costs may vary depending on the specific circumstances of the sale.

How much are solicitors fees for selling a house UK?

How much are escrow fees for sellers in California?

The cost of escrow fees for sellers in California can vary depending on the location, type of property, and the escrow company used. On average, escrow fees in California range from 0.2% to 1.0% of the sale price of the property. For example, if the sale price of the property is $500,000, the escrow fee could range from $1,000 to $5,000.

Factors Affecting Escrow Fees in California

Escrow fees in California are influenced by several factors, including:

- Location: Escrow fees can vary depending on the location of the property. For instance, properties located in urban areas such as Los Angeles or San Francisco may have higher escrow fees than those located in rural areas.

- Type of property: The type of property being sold can also impact escrow fees. For example, commercial properties may have higher escrow fees than residential properties.

- Escrow company: The escrow company used can also affect the fees. Some escrow companies may charge higher fees than others.

Who Pays Escrow Fees in California?

In California, the parties responsible for paying escrow fees are typically negotiated between the buyer and seller as part of the sale agreement. However, it’s common for the seller to pay the escrow fees, especially in residential transactions.

What Do Escrow Fees Cover in California?

Escrow fees in California cover a range of services provided by the escrow company, including:

- Preparing and reviewing escrow instructions

- Holding and disbursing funds as instructed

- Recording documents with the county recorder’s office

- Providing escrow accounting and reporting

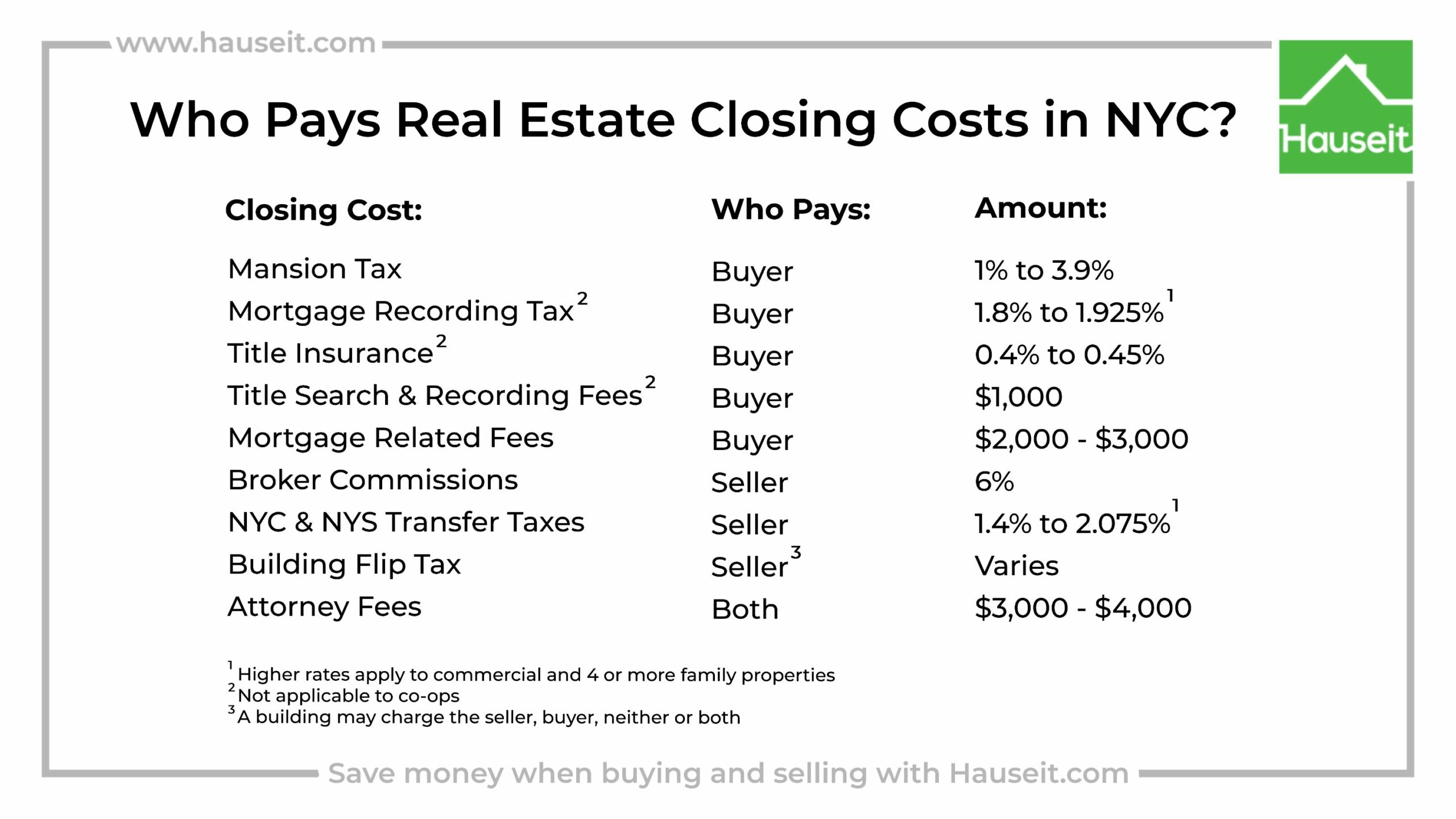

How much does a lawyer charge for a house closing in NY?

The cost of hiring a lawyer for a house closing in New York can vary widely depending on several factors, including the lawyer’s experience, the complexity of the transaction, and the location of the property. On average, a lawyer’s fee for a house closing in New York can range from $1,500 to $5,000 or more.

Factors Affecting Lawyer’s Fees for House Closing in NY

Several factors can influence the cost of hiring a lawyer for a house closing in New York. These include:

- Type of property: The type of property being purchased can impact the lawyer’s fee. For example, a commercial property or a new construction may require more complex legal work, leading to higher fees.

- Location: Lawyers in urban areas like New York City may charge more than those in rural areas.

- Lawyer’s experience: More experienced lawyers may charge higher fees than less experienced ones.

What is Included in a Lawyer’s Fee for House Closing in NY

A lawyer’s fee for a house closing in New York typically includes:

- Review and preparation of contract of sale

- Conducting title search and review

- Preparing and reviewing closing documents

- Attending the closing and ensuring a smooth transaction

- Providing legal advice throughout the process

How to Save on Lawyer’s Fees for House Closing in NY

To save on lawyer’s fees for a house closing in New York, consider the following:

- Shop around: Compare fees and services from different lawyers to find the best deal.

- Negotiate: Ask the lawyer if they can negotiate their fee or offer a discount.

- Consider a real estate attorney with lower overhead costs, such as one who works remotely.

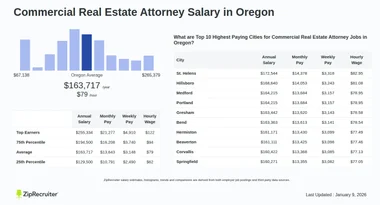

How much does a real estate attorney cost in Oregon?

The cost of a real estate attorney in Oregon can vary depending on several factors, including the complexity of the transaction, the attorney’s experience, and the location. On average, a real estate attorney in Oregon may charge between $150 to $500 per hour. For a typical residential real estate transaction, the total cost can range from $500 to $2,000 or more.

Factors Affecting the Cost of a Real Estate Attorney in Oregon

The cost of a real estate attorney in Oregon can be influenced by several factors, including:

- The type of transaction: Commercial transactions, for example, may be more complex and require more time, resulting in higher costs.

- The attorney’s experience: More experienced attorneys may charge higher rates.

- The location: Attorneys in larger cities like Portland may charge more than those in smaller towns.

- The complexity of the transaction: Transactions involving disputes or unusual circumstances may require more time and expertise, resulting in higher costs.

Tasks Performed by a Real Estate Attorney in Oregon

A real estate attorney in Oregon may perform a variety of tasks, including:

- Reviewing and drafting contracts and agreements

- Conducting title searches and resolving title issues

- Representing clients in negotiations and disputes

- Providing advice on legal and regulatory compliance

- Facilitating closings and ensuring a smooth transaction

Benefits of Hiring a Real Estate Attorney in Oregon

Hiring a real estate attorney in Oregon can provide several benefits, including:

- Protection from legal and financial risks

- Expertise in Oregon real estate law and regulations

- Guidance throughout the transaction process

- Negotiation and dispute resolution skills

- Peace of mind knowing that your interests are being protected

More Information

What are the typical solicitors’ fees for selling a house in the UK?

The typical solicitors’ fees for selling a house in the UK can vary depending on the location, type of property, and complexity of the transaction. On average, you can expect to pay between £500 to £1,500 plus VAT, which is usually around 20% of the total fee. This amount covers the cost of the solicitor’s time, expertise, and other expenses incurred during the conveyancing process. Some solicitors may also charge additional fees for services such as preparing and sending documents, conducting searches, and dealing with mortgage lenders.

What services are included in the solicitors’ fees for selling a house?

The solicitors’ fees for selling a house typically include a range of services, such as preparing the sale contract, dealing with the buyer’s solicitor, conducting searches and enquiries, obtaining and reviewing title deeds, preparing and sending documents, and handling the transfer of ownership. The solicitor will also ensure that all necessary paperwork is completed and filed with the relevant authorities, and that the sale is completed in accordance with the terms of the contract. Additionally, the solicitor may also assist with negotiating the sale price and terms, and providing guidance on any complex issues that arise during the transaction.

Can I negotiate the solicitors’ fees for selling a house?

Yes, it is possible to negotiate the solicitors’ fees for selling a house. Some solicitors may be willing to offer a fixed fee or a discounted rate, especially if you are selling a high-value property or have a complex transaction. You can also shop around and compare quotes from different solicitors to find the best deal. However, be wary of very low fees, as they may not include all the services you need or may come with hidden costs. It’s essential to carefully review the quote and ask questions about what is included and what is excluded before making a decision.

How can I reduce the solicitors’ fees for selling a house?

There are several ways to reduce the solicitors’ fees for selling a house. One option is to use an online conveyancing service, which can often be cheaper than traditional high-street solicitors. You can also consider using a fixed-fee solicitor, who will charge a set amount for their services rather than an hourly rate. Additionally, you can try to negotiate with the solicitor to see if they can offer a discount, especially if you are selling multiple properties or have a long-term relationship with them. Finally, make sure you understand what is included in the fee and ask questions about any additional costs or disbursements to avoid surprise bills down the line.